It seems pertinent that only the indexes that one can leverage in

quantity with futures - the S&P and Nasdaq - have risen over the

past half year. Maybe this selectivity is for technical reasons, but

there might be another explanation. Institutions, not the public, have

driven the rally, and they can borrow billions of dollars from banks to

leverage their bets.

The divergent action among the indexes suspiciously fits the circumstance that major investment banks can make a lot of money by buying futures and then committing their own clients' funds to buying stocks that push up those particularly underlying indexes. They could even sell other stocks to make it happen. Employing that strategy would account for the big differences in in the averages over the past half-year. The low volume and volatility help to serve up the opportunity. When the current plateau of optimism ends, the indexes..... this is an excerpt from page 7 of the 40 page The State of the Global Markets -- 2013 Edition report, FREE DOWNLOAD. Follow this link to download your free 40-page report, The State of the Global Markets -- 2013 Edition, now.

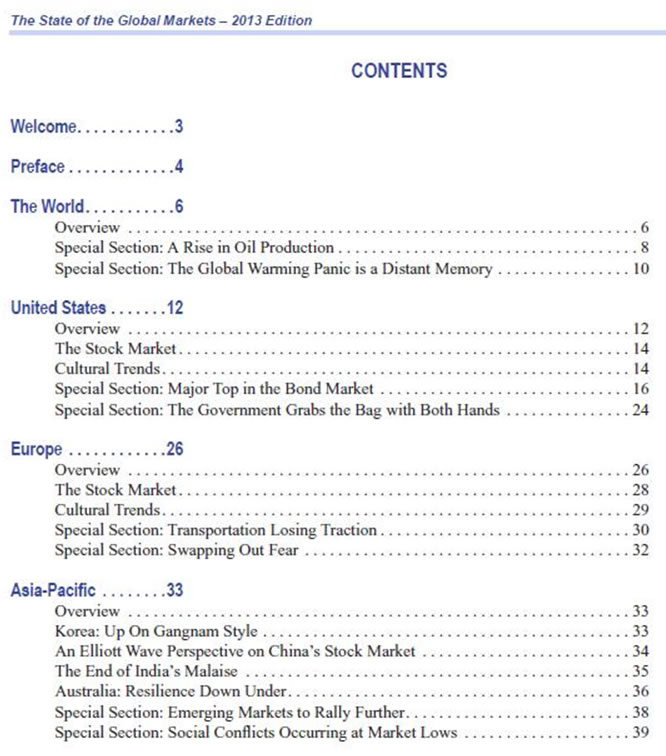

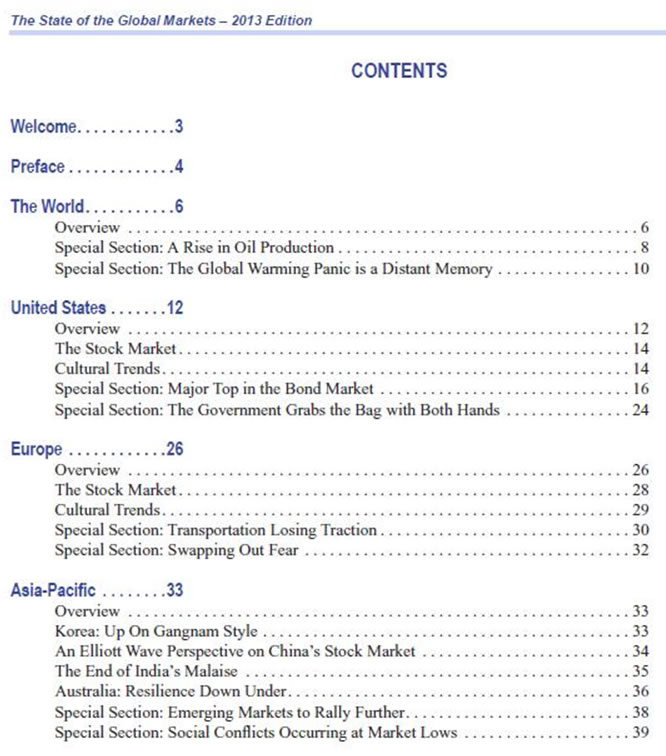

Contents Preview:

IMPORTANT: Please don't buy or sell a single share of stock -- anywhere in the world -- without reading this report first.

With our best wishes for a prosperous New Year,

P.S. This report is available to you for free for a limited time, exclusively from EWI. Please download it now while its valuable year-in-preview advice can help your portfolio in the New Year. Download the 40-page report now.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

By http://www.marketoracle.co.uk

The divergent action among the indexes suspiciously fits the circumstance that major investment banks can make a lot of money by buying futures and then committing their own clients' funds to buying stocks that push up those particularly underlying indexes. They could even sell other stocks to make it happen. Employing that strategy would account for the big differences in in the averages over the past half-year. The low volume and volatility help to serve up the opportunity. When the current plateau of optimism ends, the indexes..... this is an excerpt from page 7 of the 40 page The State of the Global Markets -- 2013 Edition report, FREE DOWNLOAD. Follow this link to download your free 40-page report, The State of the Global Markets -- 2013 Edition, now.

Contents Preview:

IMPORTANT: Please don't buy or sell a single share of stock -- anywhere in the world -- without reading this report first.

With our best wishes for a prosperous New Year,

P.S. This report is available to you for free for a limited time, exclusively from EWI. Please download it now while its valuable year-in-preview advice can help your portfolio in the New Year. Download the 40-page report now.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

By http://www.marketoracle.co.uk