DB is maintaining its bullish stance on gold. Here is their reasoning:

1. As discussed earlier (see post), the impact of QE3 on bank reserves has been modest thus far. That may explain in part why gold is lagging previous QE cycles (see discussion). As base money expands, gold prices should be supported (particularly if we see further dollar weakness).

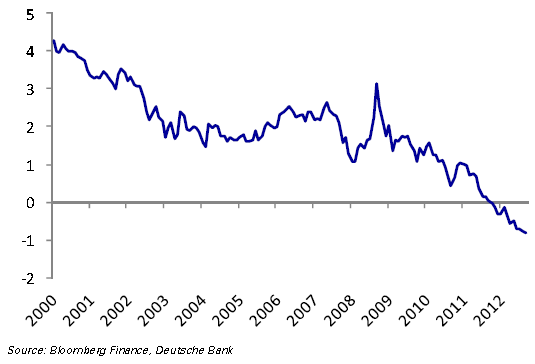

2. US long-term real rates are staying in negative territory (see post). Cash is increasingly expensive to hold, which also provides support to gold prices.

3. DB is also looking at China as the reason for stronger gold prices.

- China’s demand for gold is expected to outstrip supply.

DB: – China’s Ministry of Industry and Information Technology launched a new guidance regarding the development of the gold industry this week. In contrast to discreet gold reserve purchases, it is worth noting that the central government is now officially emphasizing the property of gold as currency and its irreplaceable role in preserving wealth during financing crises and safeguarding national economic security.

According to the Ministry, China’s gold demand has grown rapidly in recent years, a function of increased need of hedging inflation and financial risks, growing interest in gold reserves by global central banks and rising demand from the private sector. In 2011, China’s jewelry, gold bars, gold coins, industrial and other gold consumption reached 761 tons, the second in the world after India. On the supply side, China’s gold producers faces a number of challenges including scattered resources, low grade, high cost and deep extraction, which will constrain gold production growth. As a result, China’s gold demand will continue to exceed supply over the next few years. The Ministry expects that in 2015 China’s gold demand could exceed 1000t while domestic supply could only reach 450t.

- Longer term, DB expects the RMB to challenge the US dollar as the world’s reserve currency. To support its currency China will need gold reserves that at least rival that of the US. That means significant new central bank purchases.

US 10y Real Yield (source: DB)