Last week I published the 3 bullish signs in a sea of negativity (click here). So I figured I’d even the score and mark down some of the more bearish economic signs I’ve been seeing lately.

Yes, there’s a lot to be negative about, but one could easily argue that the negativity is justified. The following indicators are all important barometers of economic growth. This will be sure to brighten your day before you head into the weekend!

Rail Traffic is grinding to a halt. As I noted earlier, rail traffic is slowing substantially. This week’s data showed negative growth in intermodal traffic and the 12 week moving average has slowed to just 1.65%. This has tended to be a leading indicator of recession so the downtrend in this data is certainly a red flag.

Yes, there’s a lot to be negative about, but one could easily argue that the negativity is justified. The following indicators are all important barometers of economic growth. This will be sure to brighten your day before you head into the weekend!

Rail Traffic is grinding to a halt. As I noted earlier, rail traffic is slowing substantially. This week’s data showed negative growth in intermodal traffic and the 12 week moving average has slowed to just 1.65%. This has tended to be a leading indicator of recession so the downtrend in this data is certainly a red flag.

(Chart via Orcam Investment Research)

Manufacturers’ New Orders have turned sharply negative.

This has been discussed quite a bit in the analyst community and while

it’s not necessarily an immediate sign of recession, like rail traffic,

it is one of the glaring warning signs of just how weak this economy

is.

(Chart via Dshort)

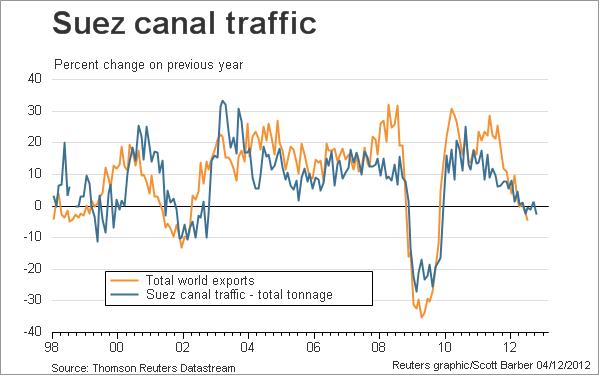

Suez Canal Traffic is turning negative. The

Suez is one of the most trafficked waterways in the world and an

indicator of global economic growth. The chart below (via Reuters)

shows that total tonnage and global export traffic have turned negative.

Article Source: PragCap