Each New Rally Stinks Worse Than Beached Clams

With a closet Marxist in the White House for four more years and the U.S. economy headed into something worse than recession, we should view any significant stock-market rally as a golden opportunity to bet against the house. Under the circumstances, yesterday’s 107-point tumescence in the Dow offered a tempting opening. Not quite yet, though. Our coldly mechanical technical indicators say stocks could go at least somewhat higher before they become engorged to the bursting point. Speaking more subjectively, any market-watcher with olfactories could tell you that the broad averages, currently hovering within easy distance of new all-time highs, stink worse than a clam’s crotch. Consider the backdrop: taxes on income and investment are about to rise steeply; public spending outside of Washington is imploding; corporate earnings have been deflating since summer; new hiring will be asphyxiated by 2000 pages of Obamacare; and America’s drug-induced housing “recovery” is about to breathe its last.

That last item has been a source of hope and comfort for the Administration and Wall Street, but why should we, too, be comforted by a story that has been spun by thieves, mountebanks, liars, drop culls, arse bandits and worse? When you consider what went into creating the current real estate blip-let, you start to understand why it cannot go on indefinitely. Sure, the Fed could continue to monetize mortgage securities at the rate of $40+ billion a month, and to warehouse mountains of worthless paper associated with untold inventories of vacant houses. Unfortunately for the spinmeisters, however, the supply of qualified buyers and re-fi seekers is certain to dry up well ahead of the economy’s impending crash.

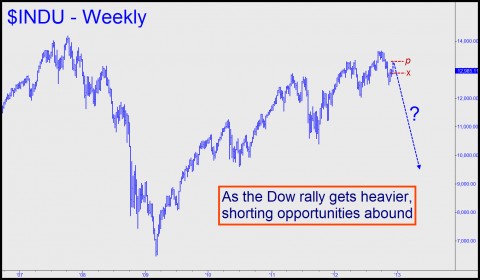

Concerning the stock market, look at the Dow chart above and you can almost feel the weight of supply as each distributive rally has struggled harder and harder to match the last. From a technical perspective, we’ll be watching most immediately for opportunities to get short speculatively near ‘p’. If you don’t subscribe but would like to know the exact location of this “hidden” resistance point, click here. The set-up we’re aiming for would probably use puts or calls in the Diamonds, a proxy for the Dow Industrials. Our further goal would be to lay off our bets if the reversal from ‘p’ occurs as expected. Please note as well that Rick’s Picks seldom advises initiating long or short positions exactly at Hidden Pivots. Rather, we look for “camouflage” entry opportunities near these numbers, the goal being to dramatically lower our entry risk. With a little luck and very good timing, we can actually hope to make money even when we are wrong. Skeptical of that claim? Drop by the chat room and ask some Hidden Pivot traders yourself.

rickackerman

With a closet Marxist in the White House for four more years and the U.S. economy headed into something worse than recession, we should view any significant stock-market rally as a golden opportunity to bet against the house. Under the circumstances, yesterday’s 107-point tumescence in the Dow offered a tempting opening. Not quite yet, though. Our coldly mechanical technical indicators say stocks could go at least somewhat higher before they become engorged to the bursting point. Speaking more subjectively, any market-watcher with olfactories could tell you that the broad averages, currently hovering within easy distance of new all-time highs, stink worse than a clam’s crotch. Consider the backdrop: taxes on income and investment are about to rise steeply; public spending outside of Washington is imploding; corporate earnings have been deflating since summer; new hiring will be asphyxiated by 2000 pages of Obamacare; and America’s drug-induced housing “recovery” is about to breathe its last.

That last item has been a source of hope and comfort for the Administration and Wall Street, but why should we, too, be comforted by a story that has been spun by thieves, mountebanks, liars, drop culls, arse bandits and worse? When you consider what went into creating the current real estate blip-let, you start to understand why it cannot go on indefinitely. Sure, the Fed could continue to monetize mortgage securities at the rate of $40+ billion a month, and to warehouse mountains of worthless paper associated with untold inventories of vacant houses. Unfortunately for the spinmeisters, however, the supply of qualified buyers and re-fi seekers is certain to dry up well ahead of the economy’s impending crash.

Heavy Supply

Concerning the stock market, look at the Dow chart above and you can almost feel the weight of supply as each distributive rally has struggled harder and harder to match the last. From a technical perspective, we’ll be watching most immediately for opportunities to get short speculatively near ‘p’. If you don’t subscribe but would like to know the exact location of this “hidden” resistance point, click here. The set-up we’re aiming for would probably use puts or calls in the Diamonds, a proxy for the Dow Industrials. Our further goal would be to lay off our bets if the reversal from ‘p’ occurs as expected. Please note as well that Rick’s Picks seldom advises initiating long or short positions exactly at Hidden Pivots. Rather, we look for “camouflage” entry opportunities near these numbers, the goal being to dramatically lower our entry risk. With a little luck and very good timing, we can actually hope to make money even when we are wrong. Skeptical of that claim? Drop by the chat room and ask some Hidden Pivot traders yourself.

rickackerman